“Crypto Frenzy: The Risks of Pump-and-dump Investing in a Wild Market”

The crypto market has seen unprecedented growth and volatility in recent years, with many investors looking to cash in on the hype. However, this fervor can also lead to reckless speculation, leaving some individuals vulnerable to the dangers of pump-and-dump schemes.

What are pump-and-dump schemes?

Pump-and-dump schemes are a type of online investment scam that involves artificially inflating the price of a cryptocurrency or other investment asset through false or deceptive marketing efforts. The “pump” phase typically begins when an individual or group promotes their investment opportunity, generating excitement and hype around the project.

As the market increases in value, those at the top can lose their holdings, selling them at the inflated price to make a profit. Meanwhile, unsuspecting investors buy into the hype, buying large quantities of the cryptocurrency at the high prices created by the firecrackers. The result is a sharp drop in value once the market cools, leaving many investors with significant losses.

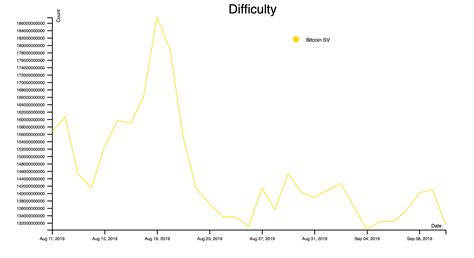

Bitcoin SV (BSV): A Complex and Volatile Asset

Bitcoin SV (BSV) is a cryptocurrency that was launched in 2018 as an upgrade to the Bitcoin blockchain. While BSV has attracted some investors due to its potential for increased scalability and decentralization, it has also faced scrutiny from regulators and critics who question its legitimacy.

One of the main concerns surrounding BSV is the lack of transparency regarding its development team and the network’s source code. This has led to accusations that BSV may be a “Ponzi scheme” or other types of investment scam, as some critics have raised questions about the legitimacy of the token.

Risks of Investing in BSV

Investors should be cautious when considering investing in BSV or any other cryptocurrency. Here are some potential risks to watch out for:

- Lack of Transparency: As mentioned earlier, the BSV development team and source code can be opaque, raising concerns about the legitimacy of the token.

- Regulatory Scrutiny: Governments around the world have expressed concerns about cryptocurrencies like BSV, which could lead to increased regulatory pressure on investment firms offering these assets.

- Price Volatility: Like any other cryptocurrency, BSV is subject to price fluctuations, which can lead to significant losses if investors do not stay informed and adjust their positions accordingly.

Pump and Dump Investing: A Recipe for Disaster

Investing in cryptocurrencies or any other asset should always be done with caution and with a clear understanding of the risks involved. Pump and dump schemes are particularly dangerous due to their ability to exploit vulnerable individuals and groups.

As the cryptocurrency market continues to evolve, it is essential for investors to remain vigilant and do their research before making investment decisions. This includes:

- Doing your due diligence: Before investing in any cryptocurrency or asset, do your own research and understand the risks involved.

- Diversifying your portfolio: Spread your investments across a wide range of assets to minimize risk.

- Avoid unsolicited advice: Be wary of unsolicited investment recommendations from unverified sources.

In conclusion, while cryptocurrencies like BSV have garnered attention in recent years, it is essential that investors approach these markets with caution and respect. Pump-and-dump schemes are particularly dangerous due to their ability to exploit vulnerable individuals and groups. By doing your research, diversifying your portfolio, and avoiding unsolicited advice, you can minimize the risks involved and make more informed investment decisions.