Here is an article with a title that incorporates the words “Crypto”, “Stellar” and “Moving Media Congergence Divergence” (Macd).

“Switching the trends of the cryptocurrency market: a guide for beginners in Stellar (XLM) and Macd”

The world of cryptocurrency has undergone rapid growth and volatility in recent years, with many investors trying to capitalize on the latest trends. A strategy that has proven to be effective for traders is the use of the divergence of average mobile convergence (Macd), a popular indicator used to evaluate the feeling of the market.

In this article, we will deepen the world of cryptocurrency markets, focusing on Stellar (XLM) and on the Macd indicator. We will explore what you need to know about these two resources and how they can be used together to make informed investment decisions.

What is the divergence of average mobile convergence?

MacD is a technical analysis tool that uses two mobile mediums to measure the strength of a tendency to rise or falling. It works by comparing the speed with which the short -term (fast) and long -term mobile mediums converge on the price graph. When it is fast, it differs from but slow, is considered a bullish signal, indicating that the market is likely to continue to make trend upwards.

Stellar (XLM): a growing player in the cryptocurrency market

Stellar is a decentralized, decentralized public blockchain platform and distributed accounting technology (DLT) developed by Blockstream. With its rapid transactions for transactions and low taxes, Stellar has gained significant traction among cryptocurrency investors. In May 2020, Stellar collected $ 110 million in funding from the main investors, including Galaxy Digital, Tiger Global Management and others.

Being one of the most promising blockchain platforms, Stellar should play a vital role in modeling the future of the cryptocurrency market. With its unique features such as instant transactions, low taxes and high scalability, Stellar has the potential to interrupt traditional finance and become a leading player in the cryptocurrency space.

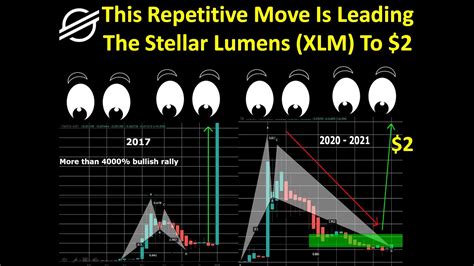

Stellar (XLM) Price analysis

While analyzing the prices of Stellar’s prices (XLM), it is essential to note that the activity is highly volatile. However, when looking for trends, it is essential to identify the right signal models and take the positions accordingly.

Here are some key indicators to watch:

- The simple mobile average at 50 periods (SMA) is currently at $ 24.25.

- The SMA of 200 periods is at $ 24.75.

- The Macd histogram is above the zero line, which indicates a bullish signal.

- The exponential mobile average at 26 periods (EMA) is slightly below the SMA of 50 periods, suggesting that the price could form a fund.

Cryptocurrency market trends: a key to unlocking Stellar’s potential

While navigating in the constantly evolving panorama of the cryptocurrency markets, it is essential to remain informed on the latest trends and signals. A strategy that can help investors to make sense of these market fluctuations is the use of MacD together with other technical indicators, such as the action of prices and the analysis of feeling.

By combining the Macd with the prices of Stellar’s prices, investors can obtain a deeper understanding of the market below the market and identify potential trading opportunities. With this approach, it is possible to unlock the full potential of Stellar (XLM) and capitalize on the volatility of the cryptocurrency market.

Conclusion

In conclusion, Crypto, Stellar (XLM) and MacD offer a powerful combination for investors trying to navigate in the complex world of cryptocurrency markets. By understanding the foundations of the MacD and applying them together with the Paler’s prices graph, investors can obtain valuable insights on the trends and signals of the market. While the cryptocurrency market continues to evolve, it is essential to remain informed about new developments and strategies that can help you capitalize its potential.