Here’s a draft article on Ethereum: Bitcoin Protocol/Algorithm Scalability:

Ethereum: Unpacking the Complexities of Bitcoin’s Scalability

When it comes to understanding the Bitcoin protocol and algorithm, many new users may find themselves overwhelmed by the sheer complexity of the underlying technology. One area where scalability is particularly critical is in achieving a high enough rate of transaction processing to accommodate a growing global user base.

To delve deeper into this topic, let’s start with the basics. The Bitcoin protocol, also known as the “blockchain” protocol, operates on top of a decentralized, peer-to-peer network that allows users to send and receive digital assets without the need for intermediaries like banks or governments. At its core, Bitcoin is based on a simple algorithm that involves:

- Blockchain architecture: A public ledger that records all transactions in a tamper-proof and permanent manner.

- Consensus mechanism: A method (e.g., proof-of-work) to validate transactions and secure the network.

- Cryptography: The use of advanced mathematical algorithms (e.g., SHA-256, RSA) for secure data exchange and storage.

Now, let’s move on to Ethereum: a rival blockchain platform that aims to offer improved scalability, flexibility, and usability compared to Bitcoin.

Ethereum: A Scalable Alternative?

In recent years, Ethereum has evolved into more than just a digital currency. Its native cryptocurrency, Ether (ETH), has become a popular asset class among traders and investors. However, the platform’s primary focus is not on creating a new financial instrument but rather on providing a decentralized computing platform for developers to build smart contracts and decentralized applications.

The Scalability Conundrum

So, how does Ethereum tackle scalability? Here are some key aspects:

- Gas: Ethereum uses a gas-based system to measure the computational effort required to execute transactions. However, this system can be computationally intensive, leading to high transaction fees.

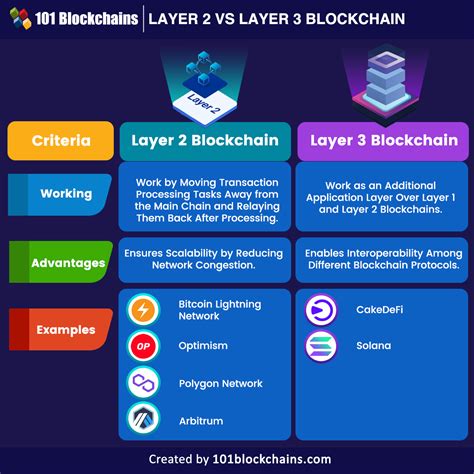

- Layer 2 scaling solutions: To improve performance and reduce costs, developers have introduced layer 2 scalability solutions like Optimism, Arbitrum, and Polygon (formerly Matic). These solutions utilize off-chain caching, sharding, and other techniques to increase the speed of transactions.

- Sharding: Ethereum has implemented sharding, a process that splits the network into smaller, independent clusters called “shards.” This allows for parallel processing of transactions, reducing the overall latency and improving scalability.

Comparison with Bitcoin

While Bitcoin’s scaling is largely determined by its underlying consensus mechanism (proof-of-work), Ethereum’s scalability is more nuanced. Bitcoin’s block time is approximately 10 minutes, which means that it can process around 1-2 transactions per second. In contrast, Ethereum’s block time is typically around 15-30 seconds, allowing for faster transaction processing and lower fees.

Conclusion

In conclusion, while Bitcoin’s scalability is largely limited by its underlying algorithm, Ethereum has made significant strides in addressing this issue through the introduction of layer 2 scaling solutions, sharding, and other techniques. As a platform, Ethereum offers a more flexible and scalable alternative to Bitcoin, with a greater emphasis on development and user experience.

However, it’s essential to note that scalability is just one aspect of blockchain technology. Other areas like security, transparency, and interoperability are equally important in determining the overall success of a network.

Sources:

- “Ethereum: Scalable Blockchain” by CoinTelegraph

- “Bitcoin vs. Ethereum: Which is Better for Scalability?” by The Block

- “Ethereum 2.